Reflexivity

How self-reinforcing and self-correcting feedback loops drive financial markets, the climate, health of ecosystems, and much more.

Happy Pi Day. In this post, I will discuss the Theory of Reflexivity as described by George Soros, and how it relates to markets, ecosystems, and the climate.

So, what exactly is reflexivity?

I can state the core idea in two relatively simple propositions. One is that in situations that have thinking participants, the participants’ view of the world is always partial and distorted. That is the principle of fallibility. The other is that these distorted views can influence the situation to which they relate because false views lead to inappropriate actions. That is the principle of reflexivity.

George Soros

Let’s break this down into some basic principles and then go from there.

Humans as thinking and acting creatures are always imperfect; perhaps acting on imperfect information or out of emotion or impulse.

These imperfections manifest in the world, and then feedback on us. The imperfect views and behavior influence the outcome, and the outcome then influences those views and behavior. A feedback loop.

A negative feedback loop is one where the participants’ views (and behavior) actually bring the state of the world closer to those views. In other words the system approaches equilibrium.

A positive feedback loop is the opposite, participants’ views (and behavior) drive the state of the world further and further from those views. Eventually, it has to be acknowledged that the views and behavior are just wrong: the system is way out of equilibrium.

Let’s focus now on that last principle. It becomes clear that a positive feedback loop cannot go on forever, as eventually you have to give in to the reality of disequilibrium. What Soros calls “dynamic disequilibrium or what may be described as far-from-equilibrium conditions”. Sound at all applicable to anything today?

The broader point here is that eventually, those conditions bring about a climactic reversal. A tipping point where everything begins to cascade in the opposite direction. This applies to financial markets in that investors’ views effect their behavior (pushing the ‘buy’ or ‘sell’ button) and that then effects the actual price through market impact. Especially if they are a big investor, like an institution or a hedge fund.

However, even a large enough group of less wealthy retail traders could get caught up in the same phenomenon, since their total market impact as a group increases with their size. Thus the market is always reflexive in that investors’ preferences indeed spread virally: from one market participant to another, and so on and so forth. Various cohorts of investors and traders get caught in feedback loops among each other, much like the observer effect in quantum physics. They are interpreting and influencing what they interpret simultaneously.

After a positive feedback process has run its course, eventually enough of a majority of participants come to the climactic point of realization that everything is out of equilibrium when considering the actual state of things. The ‘actual state of things’ is also a moving target: the state of the world is constantly shifting as is the very price being observed, since it is included in that state.

This Shows Up Everywhere

This phenomenon shows up everywhere. In the recognition of climate change, biodiversity of ecosystems, addiction treatment, as well as the politics of all the above and much more. The big questions are about over what timescales these processes play out; how long does it take to reach disequilibrium and then also how long will it take everyone to realize it? How do we recognize when we are in such a feedback loop?

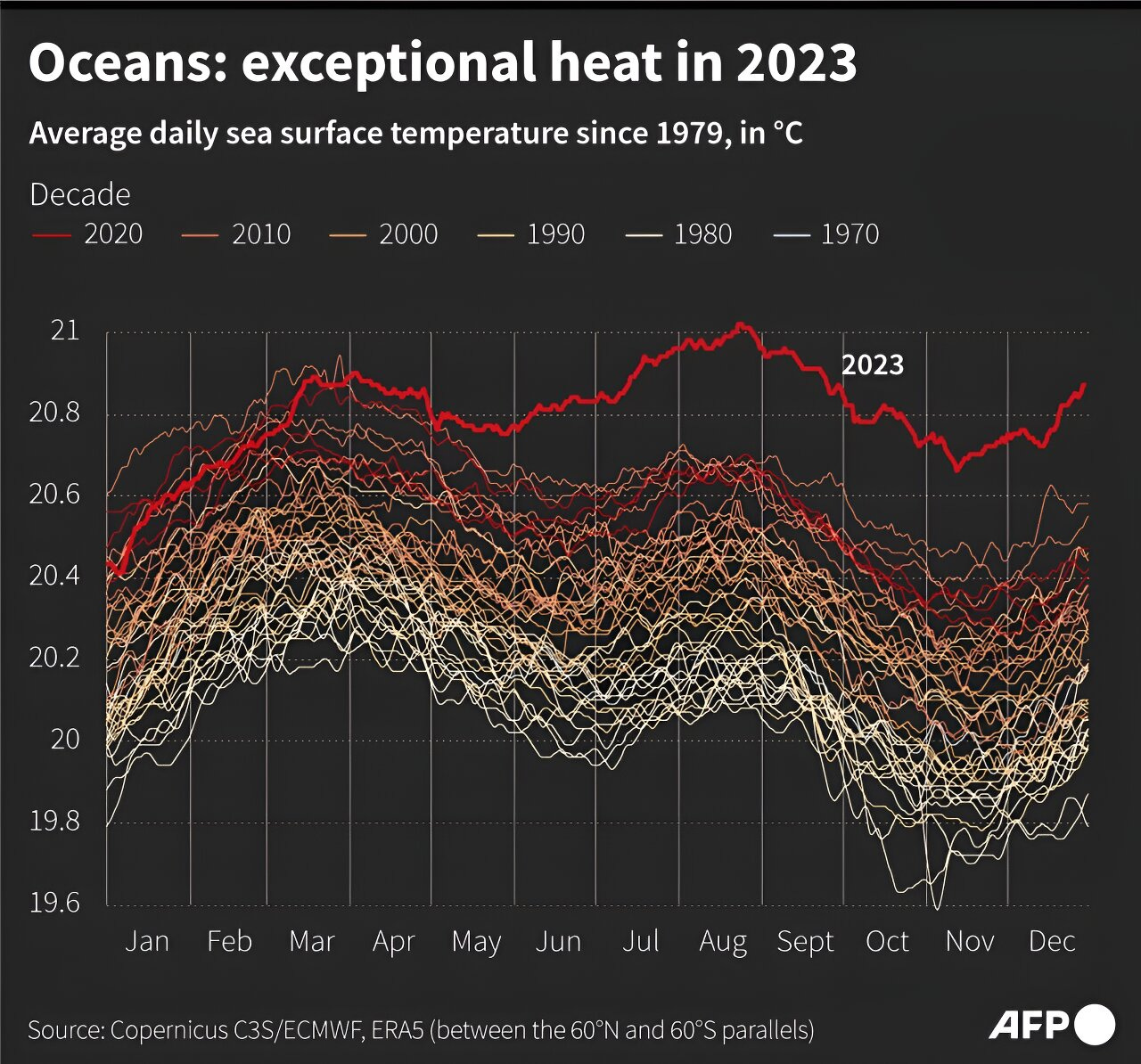

Back in May of 2023 I wrote a piece on the anomalous sea surface temperatures worrying many climate scientists. Since then, the condition has only worsened: Ocean temperature hit record high in February 2024, EU scientists say

It proved to be a year of constant record-setting sea surface temperatures well above the precedent set by the data going back to 1979. As this unfolded over the year it surprised me. I wonder how long we will have to a wait for a kind of social tipping point where enough of us realize how far from equilibrium we are headed? This is also a reflexive phenomenon because climate change has tangible effects that people will observe and experience directly. More and more will come around to the reality that it is our networked behavior as humans living in a highly industrialized global society that is driving the very thing we observe.

This is just another feedback loop. It might be slow moving, and hard to see, but it is there. The same dynamic plays out as an industrialized, or industrializing society exploits an ecosystem to make products, or exploits an entire group, as in colonialism. Or how an addict uses drugs to mask their depression (thinking it will help), which in turn only makes them more depressed. Eventually it spirals towards an unsustainable, out-of-equilibrium situation.

Hurricane Season and La Nina

The coming hurricane season of 2024 may prove to be a kind of self-correcting event for these elevated sea surface temperatures as La Nina kicks in. But it may come at the cost of some especially daunting hurricanes according to a recent article from Axios. It’s an example of our world approaching an out-of-equilibrium situation, while our collective behavior is still driving a feedback loop in the wrong direction.

References & Further Reading

Soros: General Theory of Reflexivity

George Soros

The Alchemy of Finance

George Soros

El Niño, La Niña "swing" may juice Atlantic Hurricanes

Axios

Global Warming pushes Ocean temperatures off the charts

Phys.org

Ocean Temperature hit record high in February 2024, EU scientists say

Reuters

Reflexivity

Wikipedia